Welcome to our article on the top 10 nuggets of wisdom for making retirement planning a breeze.

In today's fast-paced world, it is crucial to start early and set clear financial goals for retirement.

Understanding your income sources, maximizing benefits, and diversifying your investments are all key steps towards a secure future.

Additionally, planning for healthcare expenses and unexpected costs can provide peace of mind.

Seek professional guidance and navigate the path to financial freedom with confidence.

Start Early: The Importance of Time in Retirement Planning

One of the key factors emphasized in retirement planning is the significance of starting early. This allows individuals to take advantage of compounding interest and ensure a comfortable financial future.

Compounding interest refers to the ability of an investment to generate earnings, which are then reinvested to generate further earnings. Starting early allows for a longer time period for compounding to work its magic.

The impact of market volatility, or the fluctuation in investment values, can be mitigated by starting early as well. By starting early, individuals have the luxury of time to ride out market downturns and benefit from market upswings.

This can help to reduce the overall impact of market volatility on their retirement savings. Therefore, starting early is a crucial step in retirement planning to maximize the power of compounding and minimize the impact of market volatility.

Set Clear Financial Goals for Retirement

In order to ensure a secure and stress-free retirement, it is essential for individuals to set clear financial goals and develop a comprehensive plan that aligns with their desired lifestyle and future aspirations. Financial planning for retirement is not just about saving money; it involves making strategic decisions that will ultimately determine the quality of your golden years.

Here are three key elements to consider when setting retirement goals:

Determine your desired lifestyle: Visualize how you want to spend your retirement. Do you envision traveling the world, pursuing hobbies, or simply enjoying a peaceful life at home? Understanding your desired lifestyle will help you estimate the financial resources needed to support it.

Assess your current financial situation: Take stock of your current assets, liabilities, and income sources. This will provide a clear picture of where you stand financially and help you identify any gaps in your retirement savings.

Set realistic and attainable goals: Break down your retirement goals into manageable milestones. Determine how much you need to save each year and establish a timeline for achieving your financial objectives.

Understand Your Retirement Income Sources

Understanding your retirement income sources is crucial for a successful and secure retirement. It is important to have a breakdown of your income sources, such as pensions, Social Security, and investments, to ensure a steady stream of income in retirement.

Diversification is key, as relying on a single income source can be risky. It is also essential to consider future income needs and potential sources.

Income Sources Breakdown

Analyzing the breakdown of income sources is crucial for ensuring a secure and stable retirement. Retirement budgeting and income planning are essential components of a successful retirement strategy.

To paint a vivid picture of the income sources breakdown, consider the following:

- Social Security: A reliable foundation that provides a consistent stream of income throughout retirement.

- Pension: A traditional retirement benefit offered by some employers, ensuring a steady income flow.

- Personal Savings: Accumulated over years of diligent saving and investing, these funds serve as a safety net and supplement other income sources.

Understanding the breakdown of income sources allows individuals to assess their financial readiness for retirement and make informed decisions. It enables them to evaluate their current financial situation, determine potential gaps in income, and develop strategies to bridge those gaps.

Importance of Diversification

A comprehensive assessment of retirement income sources is essential for individuals to fully grasp the importance of diversification in their financial portfolios. Understanding risk and implementing effective portfolio management strategies are key components of a successful retirement plan.

Diversifying income streams helps to mitigate risk and protect against potential market fluctuations. By diversifying their investments across different asset classes, individuals can spread their risk and potentially increase their overall return on investment.

It is crucial for individuals to understand that relying solely on one source of income, such as Social Security or a pension, may not be sufficient to sustain their desired lifestyle in retirement. By diversifying their income sources, individuals can create a more stable and reliable financial foundation for their retirement years, providing them with the freedom and peace of mind to enjoy their golden years.

Future Income Considerations

The future income considerations for retirement planning are crucial for individuals to secure a stable and sustainable financial future. Planning for retirement involves making strategic decisions regarding future income strategies and maximizing retirement savings growth. Here are three key factors to consider when thinking about future income in retirement:

Diversification: It is important to diversify your investments to mitigate risk and ensure a steady income stream during retirement. By spreading your investments across different asset classes such as stocks, bonds, and real estate, you can minimize the impact of market fluctuations and potentially increase your overall returns.

Social Security Benefits: Understanding how Social Security benefits work and when to start claiming them is essential for maximizing your retirement income. Consider factors such as your full retirement age, the impact of early or delayed claiming, and the potential effects on your overall financial situation.

Retirement Savings Growth: Developing a long-term savings strategy that focuses on growth is crucial for building a substantial retirement nest egg. Consider investing in tax-advantaged retirement accounts such as 401(k)s or IRAs, and regularly contribute to these accounts to take advantage of compounding returns over time.

Employers' retirement plans provide valuable opportunities for employees to secure their financial future. Employer-sponsored retirement plans, such as 401(k) plans, allow employees to save for retirement by contributing a portion of their income to a tax-advantaged account. These plans often include employer matching contributions, which can significantly boost retirement savings. By participating in these plans, employees can take advantage of the power of compounding and build a substantial nest egg over time.

Retirement savings are crucial for individuals who desire financial freedom in their golden years. These funds can provide a steady stream of income, ensuring a comfortable retirement and allowing individuals to pursue their passions and interests without financial constraints. Employer-sponsored retirement plans offer a convenient and structured way to save for retirement, with contributions automatically deducted from employees' salaries. Additionally, the tax advantages of these plans, such as tax-deferred growth and potential tax deductions, further enhance the benefits of participating in employer-sponsored retirement plans.

Diversify Your Investment Portfolio

To maximize returns and reduce risk, it is important to diversify your investment portfolio by allocating funds across various asset classes, such as stocks, bonds, and real estate. Diversification is a key strategy in investment planning, as it helps to spread risk and capture potential gains from different sectors of the economy.

Here are three important reasons why diversifying your investment portfolio is crucial:

Risk Reduction: By investing in different asset classes, you can mitigate the impact of a single investment's poor performance on your overall portfolio. This helps to protect your wealth and minimize potential losses.

Opportunity for Growth: Diversification allows you to tap into different market segments, providing the potential for higher returns. While some investments may underperform, others may thrive, leading to overall portfolio growth.

Protection Against Market Volatility: Different asset classes tend to perform differently in various market conditions. By diversifying your portfolio, you can reduce the impact of market volatility on your investments, helping you weather market downturns more effectively.

Consider the Impact of Inflation on Your Retirement Savings

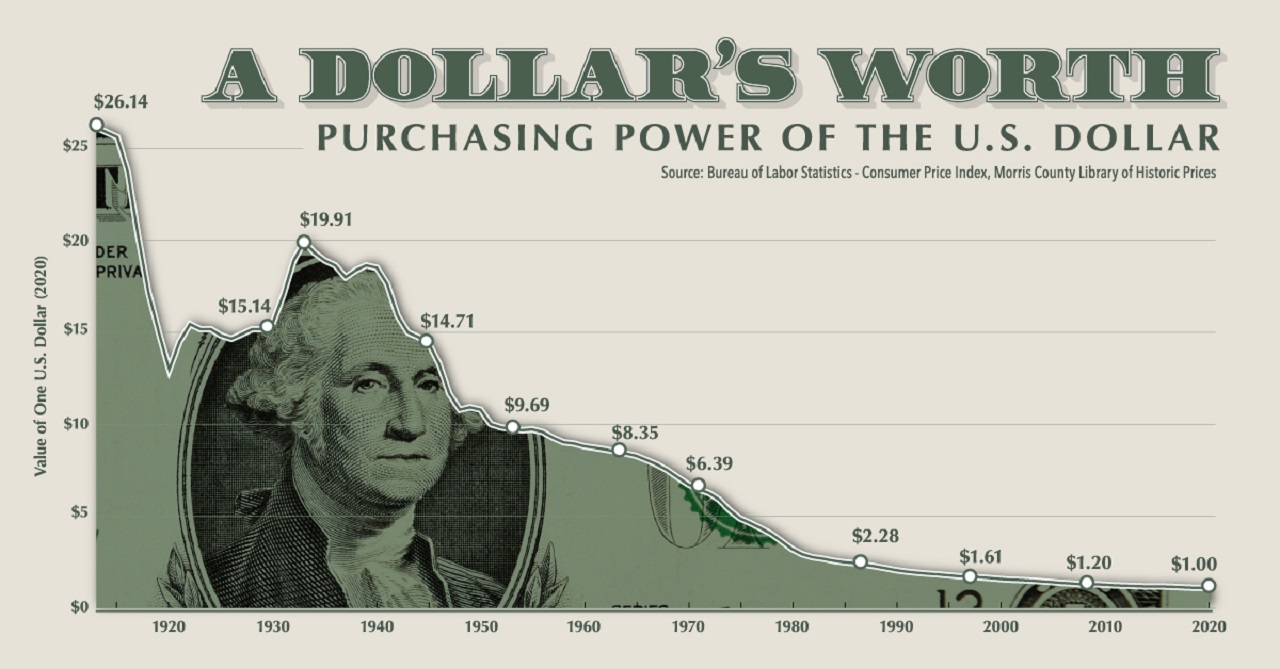

When planning for retirement, it is essential to consider the impact of inflation on your savings.

Inflation erodes the purchasing power of money over time, meaning that the same amount of money will buy less in the future.

To combat this, it is important to factor in inflation when setting retirement savings goals and to invest in assets that have historically outpaced inflation, such as stocks or real estate.

Inflation's Retirement Saving Effects

Consistently accounting for inflation is crucial for retirement savers to ensure their funds retain their purchasing power over time. Inflation erodes the value of money, reducing the amount of goods and services it can buy.

To mitigate the impact of inflation on purchasing power, retirement savers can employ the following strategies:

Diversify investments: By diversifying their portfolio across different asset classes, such as stocks, bonds, and real estate, retirees can potentially generate higher returns that outpace inflation.

Invest in inflation-protected securities: Treasury Inflation-Protected Securities (TIPS) provide a guaranteed return that adjusts with inflation, safeguarding purchasing power.

Consider annuities: Annuities offer a steady income stream throughout retirement, protecting against inflation as they often include cost-of-living adjustments.

Planning for Inflation Risk

Effectively planning for inflation risk is essential for retirement savers to safeguard the purchasing power of their savings. Inflation erodes the value of money over time, making it crucial for individuals to adjust their retirement savings accordingly. Inflation risk management involves understanding the potential impact of inflation on retirement funds and implementing strategies to mitigate its effects.

One way to manage inflation risk is by diversifying investments. By spreading investments across different asset classes, such as stocks, bonds, and real estate, individuals can potentially offset the impact of inflation on their overall portfolio.

Additionally, adjusting retirement savings for inflation is important. Regularly reviewing and increasing contributions to retirement accounts can help account for rising prices and ensure that the savings keep up with inflation.

Overall, planning for inflation risk requires a proactive approach. By understanding the impact of inflation and adopting strategies to manage it, retirement savers can safeguard their purchasing power and enjoy financial freedom in their golden years.

Plan for Healthcare Expenses in Retirement

Importantly, retirees must carefully consider and budget for healthcare expenses in retirement in order to ensure financial security and peace of mind. As healthcare costs continue to rise, it is crucial for individuals to proactively plan and save for these expenses.

Here are three key factors to keep in mind when budgeting for healthcare in retirement:

Medical Insurance: Retirees should explore their options for medical insurance coverage, such as Medicare or private health insurance plans, and understand the costs associated with each option.

Prescription Medications: The cost of prescription medications can be significant, especially for those with chronic conditions. It is important for retirees to factor in these expenses when planning their retirement savings.

Long-term Care: The possibility of needing long-term care, whether in a nursing home or through home healthcare services, should not be overlooked. This can be a substantial cost that retirees need to consider when budgeting for healthcare in retirement.

Maximize Social Security Benefits

Maximizing your Social Security benefits is a crucial aspect of retirement planning.

Understanding the age at which you should claim benefits, considering income limits, and exploring spousal and survivor benefits are key factors in optimizing your Social Security income.

Claiming Age and Benefits

To optimize one's Social Security benefits, it is crucial to carefully consider the appropriate age for claiming. Retirement benefits can vary significantly depending on when an individual chooses to start receiving them. Here are three key factors to keep in mind when deciding on the claiming age:

Financial Independence: Claiming Social Security benefits early may provide a sense of financial freedom, allowing individuals to enjoy their retirement years without worrying about income.

Longevity: On the other hand, if one expects to live a longer life, delaying the claiming age can result in higher monthly benefits, ensuring a more secure financial future.

Lifestyle and Health: Personal circumstances, such as health conditions or plans for post-retirement activities, should also be taken into account when deciding on the claiming age.

Income Limit Considerations

Understanding the income limit considerations is essential for individuals to make informed decisions about their Social Security benefits and ensure they maximize their financial security in retirement.

The income limit strategies and retirement income thresholds play a crucial role in determining the amount of Social Security benefits an individual can receive.

The income limit refers to the maximum amount of income an individual can earn without affecting their Social Security benefits. If an individual earns above the income limit, their benefits may be reduced or withheld.

Therefore, it is important for individuals to plan their retirement income carefully to avoid any negative impact on their Social Security benefits.

Spousal and Survivor Benefits

Spousal and survivor benefits play a significant role in determining the financial security of individuals and their spouses in retirement. These benefits are designed to provide support and protection for married couples, ensuring that both parties have access to a stable income even after one spouse passes away.

Here are three key aspects of spousal and survivor benefits:

Spousal Benefits: These benefits allow a spouse to receive a portion of their partner's Social Security benefits, even if they have little or no work history. This ensures that both partners can enjoy a comfortable retirement, regardless of their individual earnings.

Survivor Benefits: When a spouse passes away, the surviving partner may be eligible to receive survivor benefits based on the deceased spouse's work record. This provides financial stability and support during a difficult time, allowing the surviving spouse to maintain their standard of living.

Eligibility and Calculation: The amount of spousal and survivor benefits depends on various factors, such as the age of the spouses, their earning history, and the timing of when benefits are claimed. Understanding the eligibility criteria and how these benefits are calculated is crucial for maximizing the financial security of both partners in retirement.

Prepare for Unexpected Expenses

As you navigate through your retirement planning journey, it is crucial to allocate sufficient funds to adequately prepare for the inevitable and unforeseen expenses that may arise. Unexpected expenses can disrupt your financial stability if you are not prepared.

This is why it is essential to establish an emergency fund as part of your retirement strategy. An emergency fund acts as a safety net, providing you with the financial cushion needed to handle unexpected costs such as medical bills, home repairs, or car expenses. Experts recommend setting aside three to six months' worth of living expenses in an easily accessible account.

Seek Professional Guidance for a Secure Retirement

Regularly seeking professional guidance and carefully considering their recommendations can help individuals ensure a secure retirement. When it comes to retirement planning, professional advice is invaluable in navigating the complex landscape of financial decisions. Here are three key reasons why seeking professional guidance is crucial for retirement security:

Expertise: Financial advisors have the knowledge and experience to provide tailored advice based on your specific goals and circumstances. They can help you create a comprehensive retirement plan that takes into account factors such as savings, investments, and potential risks.

Objectivity: A professional advisor can offer an unbiased perspective, helping you make objective decisions about your retirement. They can provide an outside viewpoint and guide you towards the most suitable options, ensuring your interests are protected.

Peace of mind: By seeking professional advice, you can gain confidence in your retirement strategy. Knowing that you have a qualified expert by your side can alleviate concerns and provide reassurance that you are on the right track towards a secure retirement.

Frequently Asked Questions

What Are Some Common Mistakes People Make When Starting Their Retirement Planning?

When starting their retirement planning, people often make common mistakes that can hinder their financial freedom. These mistakes include not starting early enough, underestimating expenses, not diversifying investments, and failing to regularly review and adjust their retirement plan.

How Can I Estimate My Retirement Income From Various Sources?

Estimating retirement income from various sources is crucial for effective retirement planning. By considering income from pensions, Social Security, investments, and other sources, individuals can gain a clearer understanding of their financial future and make informed decisions.

Tax advantages can be gained through employer-sponsored retirement plans. These plans often offer tax-deferred growth on contributions, potential tax deductions on contributions, and employer contributions, which can further enhance retirement savings.

How Can I Ensure My Investment Portfolio Is Diversified Effectively for Retirement?

To ensure effective diversification in your investment portfolio for retirement, it is crucial to have a well-balanced investment allocation strategy. This involves spreading your investments across different asset classes and sectors while considering risk management techniques.

What Are Some Strategies to Minimize the Impact of Inflation on My Retirement Savings?

Inflation protection is crucial for retirement savings. Strategies like investing in inflation-adjusted bonds, diversifying assets, and regularly reviewing investments can help minimize the impact of inflation and ensure stable returns.

Network marketingWork from home jobsEntrepreneurshipAffiliate marketingFinancial freedomPrivacy PolicyTerms And Conditions

Network marketingWork from home jobsEntrepreneurshipAffiliate marketingFinancial freedomPrivacy PolicyTerms And Conditions