Securing funding for a startup can be a challenging endeavor, but with the right approach and strategy, it becomes an achievable dream.

In this article, we will outline the top 10 steps to successfully land startup funding.

From researching funding options to negotiating terms and closing the deal, we will provide practical insights and guidance to help entrepreneurs navigate the complex landscape of securing financial support for their business ventures.

Get ready to turn your startup dreams into reality.

Research and Identify Funding Options

In order to successfully secure startup funding, it is crucial to conduct thorough research and identify at least ten viable funding options. This initial step sets the foundation for a solid funding strategy analysis.

Start by researching various funding options such as angel investors, venture capital firms, crowdfunding platforms, grants, and loans. Explore each option's requirements, terms, and potential benefits. Consider factors like the amount of funding available, the level of control you are willing to give up, and the industry expertise of the investor or lender.

Develop a Solid Business Plan

To ensure the success of your startup, it is imperative to develop a solid business plan that outlines your company's goals, strategies, and financial projections.

A well-crafted business plan not only serves as a roadmap for your venture but also helps attract potential investors and secure funding.

When developing your business strategy, it is important to consider factors such as market analysis, target audience, competitive advantage, and marketing tactics.

Additionally, including clear and realistic financial projections is crucial to demonstrate the potential profitability and sustainability of your business.

Investors want to see a solid understanding of your industry, a sound plan for growth, and a realistic timeline for achieving profitability.

Build a Strong Team

During the initial stages of your startup, it is crucial to assemble a strong team that possesses the necessary skills and experience to drive the company towards success. The recruitment strategies you employ will greatly impact the team dynamics and ultimately determine the success of your startup.

One effective strategy is to focus on hiring individuals with diverse backgrounds and skill sets, as this can bring fresh perspectives and innovative ideas to the table. Additionally, it is important to prioritize cultural fit when selecting team members, as a cohesive and harmonious team can greatly enhance productivity and collaboration.

To attract top talent, consider offering competitive compensation packages, flexible work arrangements, and opportunities for growth and development. Moreover, fostering a positive and inclusive work environment will contribute to a motivated and engaged team that is committed to achieving the company's goals.

Validate Your Idea and Market

A key step in securing startup funding is to thoroughly validate your idea and market, ensuring that there is a quantifiable demand and a viable business opportunity for your product or service. Market research and customer validation are crucial for this process.

Here are two sub-lists to help you navigate this stage:

Market research:

Identify your target market and understand their needs and preferences.

Analyze the competition and identify gaps in the market that your product or service can fill.

Customer validation:

Conduct surveys, interviews, and focus groups to gather feedback from potential customers.

Test your product or service with a small group of target customers to validate its value and usability.

Create a Compelling Pitch Deck

Creating a compelling pitch deck is crucial for attracting potential investors and securing funding for your startup. By employing visual storytelling techniques and including essential content elements, such as a clear problem statement, a unique solution, and a solid business model, you can effectively communicate the value and potential of your business.

A well-crafted pitch deck not only captures the attention of investors but also showcases your professionalism and preparedness, increasing your chances of success.

Visual Storytelling Techniques

By employing strategic visual storytelling techniques, entrepreneurs can effectively communicate their startup's value proposition and captivate potential investors with a compelling pitch deck. Visual communication is a powerful tool that allows entrepreneurs to convey complex ideas in a simple and engaging manner.

Here are two key strategies to incorporate interactive storytelling into your pitch deck:

Use compelling visuals: Incorporate images, charts, and graphs to visually represent your startup's data and key metrics. This allows investors to quickly understand the value and potential of your business.

Tell a story: Structure your pitch deck like a narrative, with a clear beginning, middle, and end. Use storytelling techniques to highlight the problem your startup solves, the market opportunity, and the unique solution you offer.

Essential Content Elements

The essential content elements in a compelling pitch deck include clear problem identification, comprehensive market analysis, and a compelling solution, all of which are crucial for attracting potential investors. The content structure of a pitch deck should be concise and organized, allowing investors to quickly grasp the value proposition and potential of the startup.

Key takeaways for creating an effective pitch deck include:

Clearly identify the problem: Start by clearly defining the problem your product or service solves. Show that you understand the pain points of your target audience.

Conduct a comprehensive market analysis: Demonstrate a deep understanding of the market, including size, growth potential, and competitive landscape. Highlight your unique selling proposition.

Present a compelling solution: Clearly explain how your product or service solves the identified problem. Showcase the features, benefits, and advantages over existing solutions.

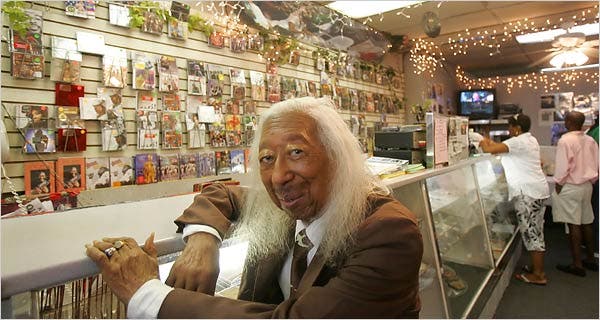

Network and Attend Startup Events

Attending and actively engaging in startup events provides entrepreneurs with invaluable opportunities to network and learn from industry experts. These events serve as a platform for attendees to connect with like-minded individuals, share ideas, and gain insights that can propel their businesses forward.

Here are some key benefits of attending startup events:

Expanded network: Startup events attract a diverse range of professionals, including investors, mentors, and potential collaborators. Building relationships with these individuals can lead to new partnerships, funding opportunities, and valuable connections.

Knowledge exchange: Startup events often feature panel discussions, keynote speeches, and workshops by industry experts. Attending these sessions allows entrepreneurs to learn from the experiences of successful individuals, gain industry insights, and stay updated on the latest trends and best practices.

Approach Potential Investors

One must proactively reach out to potential investors in order to present their startup and secure the necessary funding for its growth. Building relationships with investors is crucial for the success of any startup.

It is important to approach potential investors with a well-crafted investor pitch that highlights the unique value proposition and potential growth of the startup. When reaching out to investors, it is essential to do thorough research and identify those who have a track record of investing in similar industries or startups.

Building a solid network and attending startup events can also provide opportunities to connect with potential investors.

Remember, the investor pitch should be concise, compelling, and focused on the potential return on investment.

Negotiate Funding Terms

Startups should actively engage in open and transparent discussions with potential investors to negotiate funding terms that align with their growth objectives and ensure a mutually beneficial partnership. Effective funding negotiation strategies can help startups secure the necessary capital while maintaining control over their business. To achieve this, startups should consider the following:

Clearly define their growth objectives and funding requirements:

Determine the specific funding amount needed to achieve their goals.

Identify the key milestones and timelines for achieving growth targets.

Conduct thorough research on potential investors:

Understand their investment preferences and track record.

Evaluate their compatibility with the startup's vision and values.

By approaching negotiations with a thorough understanding of their own needs and the investor landscape, startups can effectively manage investor relations and secure funding terms that support their growth objectives.

Open communication and a balanced approach are key to establishing a successful and mutually beneficial partnership.

Prepare for Due Diligence

How can startups efficiently gather and organize all necessary documentation, while also ensuring that it is easily accessible for potential investors during the due diligence process?

Startups seeking funding must be prepared to undergo a thorough due diligence process by potential investors. This process involves a comprehensive review of the company's financials, legal documents, contracts, intellectual property, and other relevant information.

To efficiently gather and organize all necessary documentation, startups should create a due diligence checklist that outlines the required documents and information. This checklist should be regularly updated and reviewed to ensure that all documents are up to date and readily accessible.

Additionally, startups should anticipate investor expectations and proactively gather any additional documents or information that investors may require. By being proactive and organized, startups can streamline the due diligence process and present themselves as attractive investment opportunities.

Close the Deal and Secure Funding

In order to secure funding and close the deal, startups must effectively showcase their unique value proposition and demonstrate a solid growth strategy. Closing strategies play a crucial role in convincing investors to commit their funds to a venture. To successfully close the deal and secure funding, startups should consider the following strategies:

Build strong investor relations:

Develop a compelling and concise pitch deck.

Foster open and transparent communication with potential investors.

Demonstrate a solid growth strategy:

Highlight the market opportunity and potential for scalability.

Provide a clear roadmap for future growth and expansion.

By implementing these closing strategies and cultivating strong investor relations, startups can increase their chances of securing funding.

Frequently Asked Questions

How Can I Determine Which Funding Options Are the Best Fit for My Startup?

Determining the best funding options for your startup involves a thorough evaluation of your business needs, goals, and potential investors. Consider factors such as capital requirements, investor compatibility, and long-term growth strategies when making your decision.

What Are Some Key Elements to Include in a Business Plan to Make It More Appealing to Investors?

To make a business plan appealing to investors, include a thorough market analysis that demonstrates a clear understanding of the target market and its potential. Additionally, provide detailed financial projections that showcase the profitability and growth potential of the business.

How Can I Effectively Validate My Idea and Market to Ensure Its Potential Success?

To effectively validate your idea and ensure its potential success, conducting thorough market research is crucial. This involves analyzing market trends, identifying target customers, assessing competitors, and gathering feedback from potential customers to refine and improve your idea.

What Are Some Important Components to Include in a Pitch Deck to Make It Compelling and Engaging?

A compelling pitch deck should include key components such as a clear problem statement, a unique value proposition, a market analysis, a competitive analysis, a solid business model, and a well-defined financial plan. An engaging presentation should also incorporate visual aids, storytelling techniques, and a confident delivery.

How Do I Approach Potential Investors and Make a Strong Impression During Networking Events?

Approaching investors and making a strong impression during networking events requires strategic networking strategies. Building relationships is key, so focus on showcasing your unique value proposition, demonstrating market knowledge, and establishing trust to increase the chances of securing startup funding.

Network marketingWork from home jobsEntrepreneurshipAffiliate marketingFinancial freedomPrivacy PolicyTerms And Conditions

Network marketingWork from home jobsEntrepreneurshipAffiliate marketingFinancial freedomPrivacy PolicyTerms And Conditions